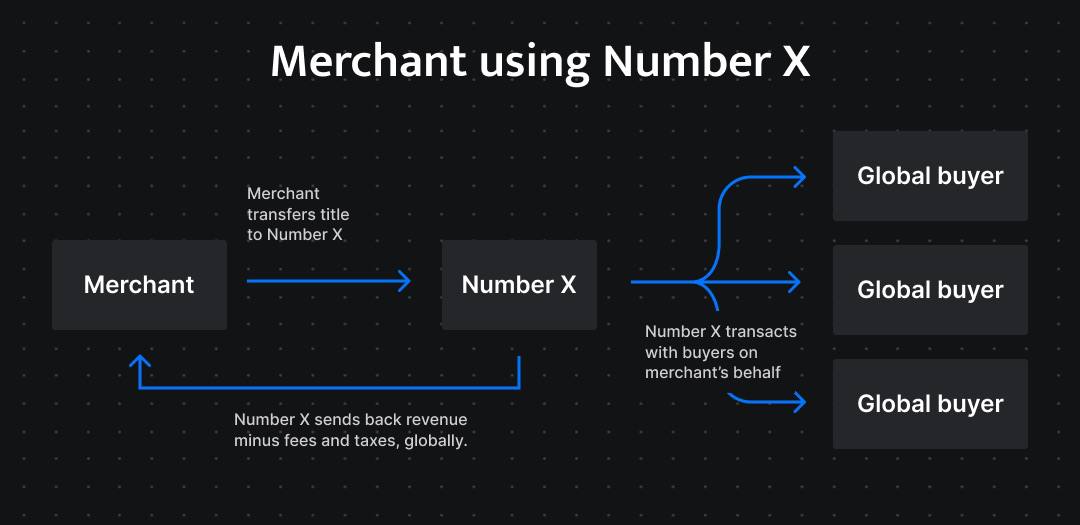

A Merchant of Record (MOR) is a company or entity that is responsible for processing payments on behalf of another company. It acts as the official seller of the goods or services being offered and assumes the responsibilities of collecting payments from end users, Tax Compliance (VAT, Sales tax calculation and remittance) handling customer support, and dealing with any chargebacks or disputes that may arise.

The use of a Merchant of Record simplifies payment processing for companies, as they do not need to set up their own merchant account and can instead rely on the MOR to handle these tasks. Using a Merchant of Record (MOR) can bring several benefits to companies.

By using Number X as a Merchant of Record, companies can outsource payment processing and rely on the MOR to handle the transaction, reducing the need for in-house expertise and resources, for example:

Reduced Risk: The MOR assumes responsibility for payment processing, handling customer service, and dealing with chargebacks and disputes, reducing the risk for the company. Increased Reach: An MOR can provide access to a wider range of payment options and a broader geographic footprint, allowing companies to reach more customers and expand their reach.

Improved Fraud Management: MORs typically have extensive fraud management systems in place, which can reduce the risk of fraud and increase the security of transactions.

Better Compliance: An MOR can help ensure that a company is in compliance with payment industry regulations and standards, reducing the risk of penalties or fines.

Cost Savings: Using an MOR can save companies the costs associated with setting up and maintaining their own merchant account and payment processing systems.

Merchant of record: radically new business model. Radically better.

Number X is a leading provider of payment solutions for businesses, selling digital products. The company offers a wide range of services to support the monetization of digital businesses, including a Merchant of Record (MOR) service.

Using Number X as a Merchant of Record provides a wide range of benefits for companies in the video game and digital entertainment industries. With Number X extensive expertise in the payment processing and fraud management, companies can rely on the company to handle these tasks effectively and securely, freeing up their own resources to focus on core business operations.

One of the key benefits of Number X Merchant Of Record service is its global reach. The company supports hundreds of payment methods and regions, allowing companies to reach a wider customer base and increase their revenue. This is particularly important for companies in the video game and digital industries, which often have a global customer base that requires access to a wide range of payment options.

Number X has robust fraud management systems in place, reducing the risk of fraud and increasing the security of transactions. Additionally, Number X is fully compliant with payment industry regulations and standards, helping companies to avoid the risk of penalties or fines.

Another key benefit of Number X MoR service is its cost savings. By outsourcing payment processing to Number X, companies can save the costs associated with setting up and maintaining their own merchant account and payment processing systems. This can be particularly beneficial for smaller companies, which may not have the resources to invest in these systems.

In conclusion, Number X is a leading provider of payment solutions for the video game and digital entertainment industries, and its Merchant of Record service provides a range of benefits for companies in these industries. With its global reach, secure and compliant payment processing, and cost savings, Number X MOR service is an excellent choice for companies looking to monetize their online and mobile games.

Number X VAT Compliance: complete guide.

Merchant of Record (MOR) is a term used in the e-commerce industry to describe a company that is responsible for processing payments on behalf of another company. In this arrangement, the MOR acts as the official seller of goods or services and assumes the responsibilities of collecting payment, handling customer service, and dealing with any chargebacks or disputes that may arise.

One of the key tasks that a Merchant of Record must perform is the calculation of Value Added Tax (VAT) for international transactions. VAT is a tax imposed by many countries on the value added to goods or services during the production and distribution process. In e-commerce, VAT can be particularly complex to calculate, as transactions often cross national borders, making it challenging to determine the correct VAT rate to apply.

When calculating VAT for international transactions, a Merchant of Record must consider several factors, including the location of the customer, the location of the seller, and the type of goods or services being sold. In some cases, the VAT rate may be determined by the customer's location, while in other cases, it may be determined by the location of the seller. In some cases, the VAT rate may be zero, while in others, it may be a substantial percentage of the transaction value.

To ensure that VAT is calculated correctly, Merchant of Record companies typically have sophisticated systems in place to manage the calculation of VAT. These systems are designed to keep track of the VAT rates that apply in different countries and regions, as well as the relevant rules and regulations that govern VAT. This allows the MOR to accurately calculate VAT for each transaction and ensure that the correct amount of tax is collected and remitted to the appropriate authorities.

In conclusion, calculating VAT for international transactions is a complex and critical task for Merchant of Record companies. To ensure that VAT is calculated correctly, it is important for companies to choose a Merchant of Record with a proven track record and a sophisticated system for managing VAT calculation. This will ensure that transactions are handled efficiently and in compliance with the relevant regulations, protecting the company and its customers from any potential issues.

Stripe vs Number X

While both Stripe and Number X might seem like similar payment processors, they differ in several key ways. The choice between the two will depend on a company's specific needs and requirements.

One advantage of using a Number X over Stripe is the level of control and customization. Merchant of Record model, offered by Number X provides additional services: VAT, Sales Tax, GST compliance (calculating and remitting taxes, registering in tax inspectorates across the globe); chargeback/refund management, end user support, antifraud, negotiating fees with various PSP’s, settlements in more than 35 currencies.

In contrast, Stripe is a more standardized payment processing solution, which may not offer the same level of customization.

Another advantage of using Number X is its ability to handle complex international transactions. Merchant of Record has the expertise and infrastructure to handle the complexities of international payments, including dealing with currency conversions and handling local taxes, such as VAT. This can be particularly important for companies that do business in multiple countries and need to ensure compliance with local laws and regulations.

Additionally, as a Merchant of Record, Number X may offer a more comprehensive range of payment options, including support for local payment methods, which can be particularly important for companies targeting international customers.

On the other hand, Stripe is known for its ease of use and integration with a wide range of e-commerce platforms and applications. This makes it a popular choice for small businesses and startups, as it provides a simple and straightforward way to start accepting payments.

In conclusion, both Stripe and Number X services have their own strengths and weaknesses, and the choice between the two will depend on a company's specific needs and requirements. For companies that require cross-border payment processing, tax compliance and other additional services, Number X may be the better choice. For small businesses and startups, Stripe may be a more attractive option due to its ease of use and well-established reputation.

Industries, where Number X is widely used

Digital businesses often use Number X services to manage the complexities of payment processing, particularly for international transactions, especially:

Subscription-based businesses: Companies offering recurring payments, such as subscription-based services, often use MoR services to handle payments and manage customer billing.

Digital content providers: Digital content providers, such as gaming companies and streaming services, use MoR services to process payments for digital goods and services.

Travel and hospitality companies: Companies offering travel and hospitality services, such as hotels and tour operators, often use MoR services to manage payments for bookings and reservations.

Affiliate marketing companies: Affiliate marketing companies use MoR services to manage payments to their affiliates and ensure compliance with local tax laws.

Software and technology companies: Companies offering software and technology products and services use MoR services to process payments for their products and ensure compliance with local tax laws.

In conclusion, a wide range of companies use Merchant of record services to manage payment processing, handle customer billing, and ensure compliance with local tax laws. The choice of a Merchant of record will depend on a company's specific needs and requirements, and its ability to handle the complexities of payment processing and customer billing.

- What Does a Merchant Do: Characteristics and Main Responsibilities7 min read / April 22, 2024

- Merchant of Record vs Payment Facilitator: What Is the Difference6 min read / April 1, 2024

- Merchant of Record vs Seller of Record: What is the difference7 min read / March 11, 2024

- What Is the Merchant Business Model?5 min read / March 20, 2024

- What is a Merchant of Record (MoR) and what role do they play in e-commerce transactions?

- How does a Merchant of Record differ from a payment processor or payment gateway?

- What are the benefits of using a Merchant of Record for global expansion in e-commerce?