If you run an online business, accepting payments in foreign currencies while complying with legal requirements in different markets might be challenging for you. There are some intermediary models that can help you manage international transactions and pay sales taxes. Using them allows you to focus on your products and leave complex financial aspects to experts. In this article, we will explain the difference between a Merchant of Record and a Payment Facilitator: what they are, how they work, and which one will be more suitable for your business.

Source: Freepik

Source: Freepik What is the Merchant of Record?

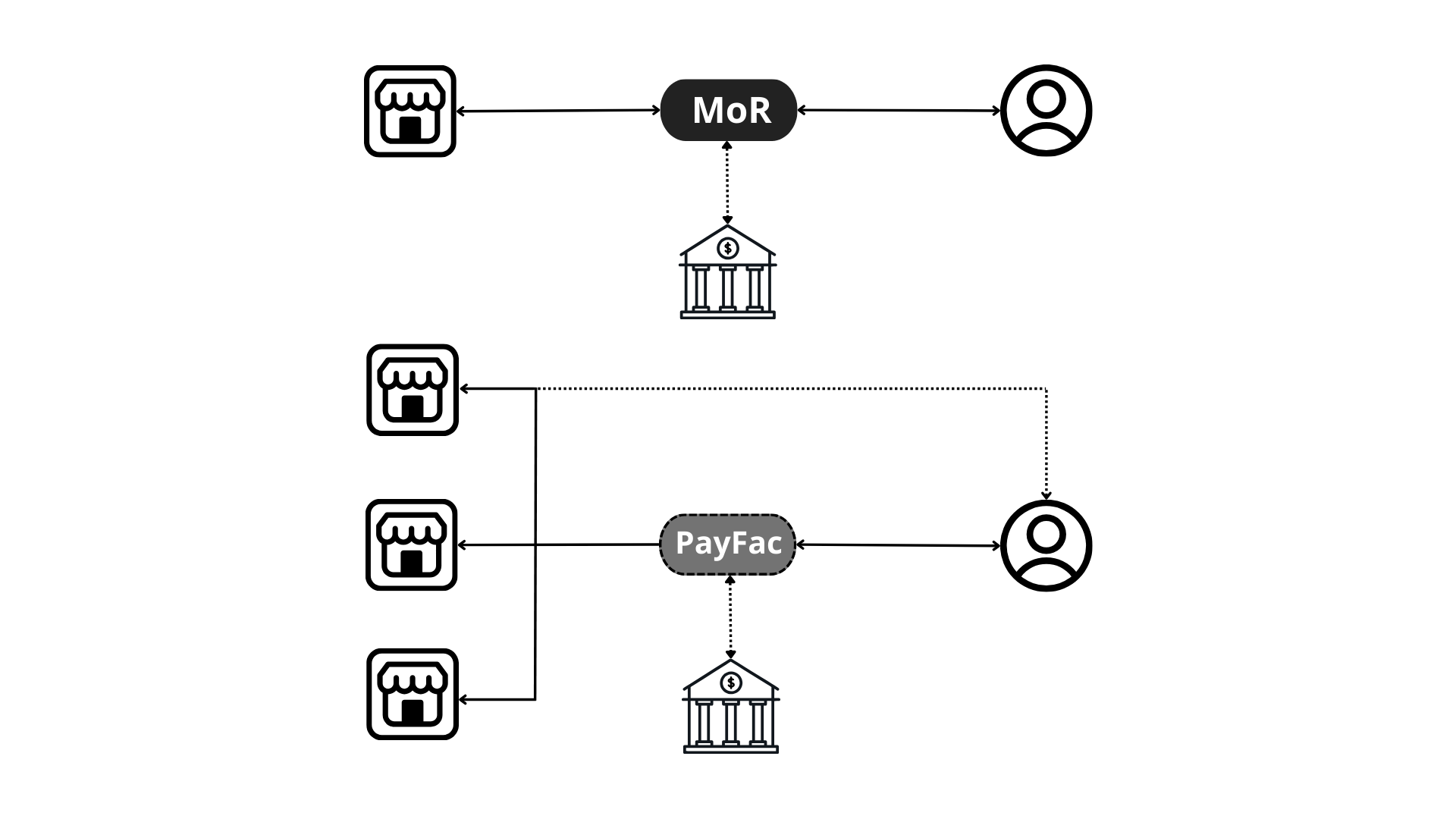

The term Merchant of Record (MoR) is widely used in e-commerce and online payments. It refers to an entity that processes and manages financial transactions on behalf of your business. the MoR acts as a mediator between a customer, an e-commerce business, or a merchant, and financial institutions involved in the payment process.

MoR’s responsibilities typically include:

- Payment processing by managing the technical infrastructure and financial transactions

- Regulatory compliance with financial and legal requirements, such as the Payment Card Industry Data Security Standard (PCI DSS) and tax laws in various jurisdictions

- Tax collection (for example, sales tax or VAT) and reporting to relevant authorities

- Fraud prevention that protects both businesses and customers

- Chargeback handling, in case a customer decides to dispute a charge on their credit card statement

- Currency conversion for processing international transactions.

Source: Freepik

Source: Freepik How Does it Work

- A customer makes a purchase on an e-commerce website and submits their payment information (credit card number, expiration date, and CVV code). The website communicates this data to a Merchant of Record.

- The MoR requests the relevant financial institutions, such as banks or credit card companies, to authorize the transaction.

- If the payment is approved, the MoR confirms the transaction to the e-commerce website, and the customer receives a confirmation that the purchase has been successful. When later the customer sees their credit card statement, the MoR’s name will appear on it.

- After deducting all applicable fees, taxes, and other charges, the MoR ensures that the money received from customer payments are settled into the merchant's account.

Thus, there are two transactions occurring at the time of purchase: the first one is between the customer and the MoR, and the second one is between the MoR and the merchant.

Examples of MoR

- Number X offers MoR services to digital businesses and the video game industry. The company works worldwide, supports a wide range of payment options, helps to manage transactions, convert currencies, and comply with taxes.

- Apple Distribution International Ltd is a subsidiary of Apple Inc. that provides services such as Apple Books, Podcasts, and App Store in Europe. The platform acts as an MoR on behalf of content providers and developers: it sets content usage rules for customers, handles all financial transactions, transfers funds to the merchants, ensures compliance in the countries of its presence, and handles customer support.

What is the Payment Facilitator

Payment Facilitators (PayFacs) are also known as Payment Service Providers (PSPs) or Merchant Aggregators. Such an entity unites multiple sub-merchants under a master bank account, enabling these companies to accept and process electronic payments. This model is beneficial to businesses that might not have resources, technical expertise, or financial stability to establish their own merchant accounts.

The key features of PayFacs are:

- Risk management, which includes implementing measures to prevent fraud, detect suspicious activities, handle chargebacks and disputes with customers.

- Compliance: PayFacs ensure that all the operations comply with financial regulations, including Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements.

- Customer support, which is provided to both sub-merchants and their customers. It covers technical assistance, payment issue resolution, and general inquiries.

How Does It Work

- Sub-merchants sign up with PayFac's platform. During the registration and onboarding process, they provide the necessary information, such as their business details, contact information, and financial data.

- When a sub-merchant accepts a payment from a customer, PayFac's platform initiates the transaction: it authorizes a payment method (by credit or debit card) and captures the funds.

- PayFac deducts its fees, and the remaining amount is settled into the sub-merchant's account.

Examples of PayFacs

- Square is a well-known PayFac that provides payment processing services to individuals and small businesses, like coffee shops, food trucks, and small-scale retailers. It offers hardware and software solutions, including point-of-sale (POS) systems, card readers, and e-commerce tools.

- Stripe is a global PayFac that specializes in online and mobile payment processing. The platform is widely used by e-commerce startups and subscription services.

- A popular e-commerce platform Shopify acts as a PayFac for more than 800,000 businesses across 175 countries. It offers a range of e-commerce tools, including payment processing, inventory management, and website design.

Difference Between Merchant of Record and Payment Facilitator

The main purpose of both an MoR and a PayFac is to make life easier for merchants by outsourcing payment processing. Nevertheless, each model has its own set of characteristics and applications. Let’s look at the comparison table below to find out essential differences between the two.

Merchant of Record (MoR) | Payment Facilitator (PayFac) | |

Responsibilities | Takes care of the entire payment process. It handles everything related to financial transactions, including tax collection and reporting. | Handles the major part of the payment process, even though sub-merchants may still have certain financial and legal responsibilities. |

Sub-Merchant Onboarding | Works with each merchant individually. | Onboards multiple sub-merchants under a single master account. |

Flexibility | Offers more flexibility in terms of customization and control over individual accounts. | Has more standardized solutions with a lesser possibility of personalization. |

Compliance | Ensures overall compliance with financial regulations. | Deals with only some compliance aspects on behalf of sub-merchants. |

Funding and Settlement | Settles funds directly into the individual merchant's bank account. Each merchant has its own settlement process. | Gathers funds in a single account to then distribute and transfer them to individual sub-merchants’ accounts. |

Risk Management | Manages risks and implements fraud prevention measures on behalf of individual merchants. | Takes on risk management for the aggregated group of sub-merchants. |

Scale | Is more suitable for larger businesses or businesses with specific needs for customization, individual control, a | Is often chosen by smaller businesses, startups, and micro-merchants. |

Business Model | Typically charges fees based on processing volumes and other variables. | Charges flat-rate fees. |

What to Choose to Work With

The decision on whether you should work with a Merchant of Record or a Payment Facilitator depends on the specifics of your business, such as:

- Your business’s size

- Transaction volume

- Resources

- Strategic objectives.

Suppose you sell digital goods to international customers; you will need professional support with operating in multiple tax jurisdictions and accepting online payments in a variety of foreign currencies. In your case, an MoR model is the better choice. Number X will take charge of managing complex payment processing and help you reduce costs, saving you the trouble of financial and legal administration.

- What Does a Merchant Do: Characteristics and Main Responsibilities7 min read / April 22, 2024

- Merchant of record (MoR): definition8 min read / March 20, 2024

- Merchant of Record vs Seller of Record: What is the difference7 min read / March 11, 2024

- What Is the Merchant Business Model?5 min read / March 20, 2024