Every merchant can face this scenario: you receive an online order paid by credit card. You ship this order and confirm the delivery. Later, your payment processor notifies you that a client filed a chargeback, claiming they have never received their goods.

Besides feeling like victims of injustice, merchants suffer from financial and reputational harm that chargebacks result in. In this article, we will explain reasons why chargebacks happen and the most effective methods to combat them.

What is Chargeback?

A chargeback is a forced reversal of a credit or debit card payment. Simply put, it is when a cardholder disputes a transaction via their bank, and the bank forcefully takes the transaction amount back from the merchant.

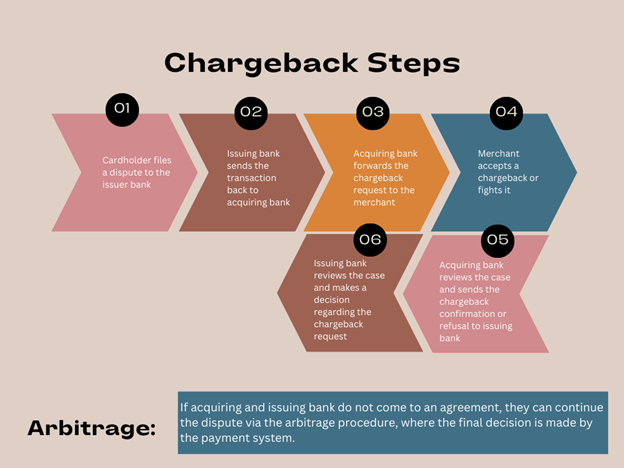

The merchant can fight the chargeback and prove that the disputed transaction was legit. The process involves banks of both parties — the merchant and the customer, as well as the payment system, which makes the final decision in case the banks are unable to come to an agreement.

Here is how it looks:

What Are The Chargeback Cases?

You might receive a chargeback for three common reasons, and not all of them depend on you as a merchant.

- Merchant’s/customer’s error. A chargeback was received because of miscommunication with the customer regarding the refund policy, wrong or uncertain product descriptions, or order mistakes. This also includes technical errors such as duplicate payments or customers' failure to identify the nature of the transaction in the statement.

Example: a customer requested a refund according to the terms and conditions (T&C). The company proceeded with the refund, but it did not appear in the bank statement, and the client filed a chargeback request.

- Criminal fraud. This kind of chargeback request comes from cardholders who want to dispute transactions they in fact never made. This happens when fraudsters steal and use credit card data for online purchases.

Example: a cardholder decided to check their bank statement and found several suspicious transactions from unknown companies. After a quick shock of realizing their card details were compromised, the cardholder immediately filed chargeback requests for all these payments.

- Friendly fraud. A chargeback abuse from the customers who don’t really have any complaints about their orders but want to receive money back through false accusations or loopholes in the banking system.

Example: a customer ordered train tickets via an online agency. After the trip, the customer decided to claim the money back and filed a chargeback describing some issues with the trip they invented on the go.

Why You Should Not Ignore Chargebacks?

The first reason for implementing measures to prevent a chargeback is costs. These costs do not simply include the returned payment amount but are also accompanied by additional fees.

Moreover, when the percentage of chargebacks is too high, this might lead to even more severe consequences — up to your account termination.

Let’s delve into the details.

- Additional fees and time

A chargeback is a costly procedure. Even if you put aside the operational and marketing costs for a service or a product a customer wants to dispute, you still need to pay various fees. These depend on a particular agreement with your partner bank. Let’s take a simple case study as an example:

| Payment Type | Fee | Total sum |

| Product cost (the amount to be refunded) | $250 | $250 |

| Shipment fee (the amount you paid for delivery) | $20 | $20 |

| Transaction fee (standard commission of your acquiring bank) | 3% | $7.5 |

| Chargeback fee (a fee you pay for every chargeback, no matter if you win or lose the dispute) | $30 | $30 |

In this case, a refund of a $250 product via a chargeback will cost $377.5. Moreover, some banks charge extra fees to continue a dispute if a merchant loses its first stage.

Besides, finance and support teams spend much time collecting evidence and preparing documents for contesting the dispute. As Andrew Saf, the chief accounting officer of an online travel agency, shared, “A dispute might last for up to six months — so it is not an issue you can always settle down quickly and easily.”

- Bank Fines

Every bank has particular obligations towards payment systems they work with. One of these obligations involves a certain chargeback percentage that must not be exceeded. Usually, this percentage may vary between 0.6% and 1%.

If a customer of the acquiring bank — e.g. a merchant — has a significantly bigger volume of chargebacks, the bank might penalize them with fines averaging $10,000.

- Account Termination

If the average chargeback number is not reduced after the fine, a bank will be forced to stop providing its acquiring services to the merchant — and will terminate the account. The biggest concern in such a situation is that it blacklists your business, so finding the new acquiring operator might become a complicated task.

How to Combat Chargebacks?

Chargebacks might sometimes occur no matter how protected you are. Still, you can significantly reduce their number and keep it within the 1% or lower threshold, mainly consisting of friendly fraud cases.

The merchant chargeback prevention measures involve enhancing the internal business workflows and implementing technical solutions alongside.

Management Methods

- Product description and T&C

A detailed description of a service or a product can become strong support when disputing chargebacks. Besides, this can significantly reduce the overall chargeback rate as the customers will be well informed on what they order. Ensure you provide clients with all product details, realistic photos, and extra comments if your service or product has particular nuances.

Andrew Saf: “We used to have a high chargeback percentage because our website’s domain name and company name — the one people saw in their statements — did not coincide. As a result, our charges appeared as transactions from some unknown company and made the customer think this was a mistake and send a chargeback request. To change that, we began sending people their train tickets and travel vouchers with a special sign highlighting the company’s name indicated in statements.”

- Manual checks and KYC procedure

Know Your Customer (KYC) implies thoroughly checking the client’s identity. This might involve requesting personal ID details, address or payment method confirmation, or other data that could help verify the customer.

The overall point of KYC is to ensure a customer is the person they claim to be. With the use of special databases and, in some cases, selective manual checks, business personnel can notice signs of suspicious behavior or fraud, and prevent further scam actions.

- Blacklists of customers

A chargeback fraud cannot be simply wrapped up even after the dispute is resolved in the merchant's favor. The next step is to protect the business against any repeated actions from the same fraudster.

Smaller companies might adopt a practice of managing blacklists manually — for example, in the form of a Google Sheets file that requires a quick check before proceeding with an order. However, a much more secure way to prevent serial fraudsters’ attacks is to organize automated blacklists via CRMs. Such lists might contain more information, including a device's IP address and a user ID, allowing you to get instant notes of a suspicious order.

A chargeback might result from miscommunication with a customer. For instance, if a client never received an item, had issues with their order, or wanted to request a refund but never managed to contact customer service, a chargeback is almost inevitable.

A more attentive approach and particular guidelines for customer support can solve issues without involving banks and payment systems. Thus, one of the chargeback prevention measures includes personnel training and creating customer support manuals for multiple scenarios.

Tech-Driven Advanced Solutions

- 3D Secure

3D Secure payments, or 3DS, require additional confirmation from the credit card holder's side. Before completing the payment, they must verify their identity by entering a personal password or a code sent to their mobile phone.

3DS solution is easily integrated with the help of acquiring banks and will minimize criminal fraud chargebacks.

Address Verification Service, or AVS, is an additional check that automatically matches the billing address in a transaction with the one indicated by the cardholder for the bank. A merchant can decline the transaction or initiate the KYC procedure if the addresses do not coincide.

Automated comprehensive verification of every transaction and suspicious payment rejection are more secure methods than manual checks performed by your personnel. For example, Sonar by Number X provides merchants with rule-based transaction checks that are customizable depending on the product type. This measure is enhanced by manual checks and embedded 3D security, aspects that help prevent 99% of fraud cases.

I Receive a Chargeback File. What Shall I Do?

- Make sure to check the chargeback response deadline.

- Find the chargeback reason via its code.

- Prepare evidence for the dispute: product description, delivery confirmation, your T&C, etc.

- Create a reply to the bank describing your case in detail.

Alternatively, you can opt for a reliable merchant of record service that will take responsibility for all payments and related issues like chargebacks. One such service is Number X, a merchant of record that covers all selling procedures, from tax management to chargeback prevention and disputes.

To Sum Up

Chargebacks will not be a severe threat if you take precautionary measures. With the right tools on hand and support from reliable partners, you can relieve the inconvenience related to transaction disputes.

- Merchant of record (MoR): definition8 min read / March 20, 2024

- Merchant of Record vs Payment Facilitator: What Is the Difference6 min read / April 1, 2024

- Merchant of Record vs Seller of Record: What is the difference7 min read / March 11, 2024

- What Is the Merchant Business Model?5 min read / March 20, 2024